401(k) vs 403(b): Understanding the Key Differences

401(k) vs 403(b): Understanding the Key Differences

Understanding employer-sponsored retirement plans is more important than ever as Americans continue to place a high priority on financial security, particularly in the face of economic instability and shifting employment trends. The 401(k) and 403(b) plans are two of the most widely used retirement vehicles in the United States.

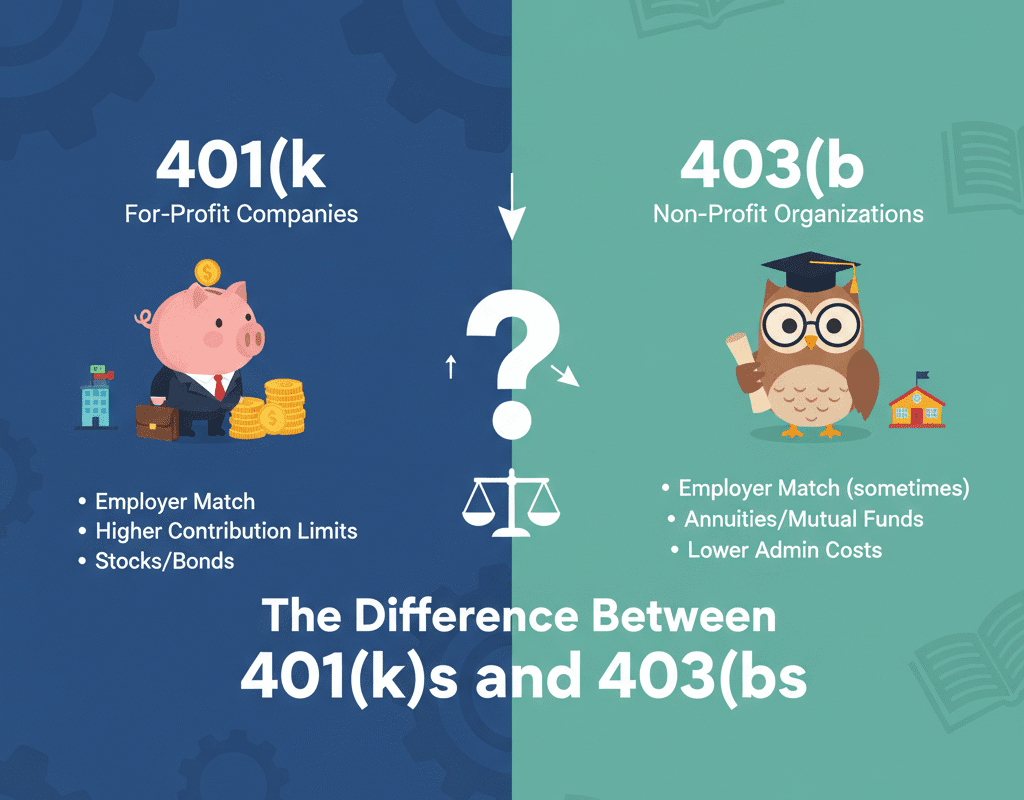

These two tax-deferred accounts, which assist employees in saving for retirement while enjoying tax benefits, seem almost identical at first glance. Their eligibility, employer kinds, investment alternatives, and certain legal criteria, however, vary.

We go over all you need to know about 401(k)s and 403(b)s in this thorough guide, including their similarities, differences, benefits, and how to select the best plan for your long-term objectives in 2025.

HSBC Cashback Credit Card 2025 – Benefits, Rewards & How to Apply?

Recognizing the Fundamentals

A 401(k): What is it?

Employers in the private sector provide retirement savings plans called 401(k)s. By depositing a portion of their pre-tax income into an investment account, employees can postpone paying taxes until they take it, which is usually after the age of 59½.

In order to encourage employees to save more, many employers additionally match a portion of employee contributions.

A firm may match 50% of your contributions up to 6% of your pay, for instance. Your long-term retirement savings can be greatly increased by this “free money.”

What is a 403(b)?

Similar to other tax-advantaged retirement savings options, public schools, colleges, hospitals, and nonprofit organizations are the main providers of 403(b) plans.

It functions similarly to a 401(k): withdrawals are taxed as regular income in retirement, investments grow tax-deferred, and contributions are made before taxes.

However, 403(b) plans frequently feature distinct investment structures, usually emphasizing mutual funds and annuities over a variety of equities or exchange-traded funds.

2025 Contribution Limits

The yearly contribution cap for 401(k) and 403(b) plans is set by the IRS. In order to account for inflation, these restrictions usually rise annually.

The anticipated contribution caps for 2025 are:

- $23,000 is the maximum employee contribution.

- $7,500 is the catch-up contribution for those over 50.

- $69,000 is the total combined employer and employee contribution cap.

The IRS restrictions for 403(b)s and 401(k)s are the same. However, if they have been employed by the same company for at least 15 years, some 403(b) participants may be eligible for an additional catch-up payment.

This special clause, which is not available in 401(k)s, permits long-term employees of nonprofit organizations or educational institutions to contribute an extra $3,000 year, up to a lifetime ceiling of $15,000.

Flexibility and Investment Options

401(k) Plans: Wide Range of Options

The majority of 401(k) plans provide a variety of investment choices, such as:

- Funds for the target date

- Index funds

- Mutual funds

- stock of the company (in certain situations)

In order to provide employees with a variety of options that are in line with their risk tolerance, employers frequently collaborate with investing firms such as Fidelity, Vanguard, or Charles Schwab.

403(b) Plans: Few but Reliable Choices

Annuities and mutual funds, which are regarded as stable, conservative investments, were the only options available for 403(b) plans in the past.

Even while there are now more mutual fund options available in modern 403(b) plans, they still often have fewer selections than 401(k)s.

Your retirement portfolio’s potential for development may be impacted by this distinction, particularly if you favor active investment management or exposure to a wider variety of asset types.

Employer Matching and Contributions

Employer matching is permitted under both plans, however the availability and structure may vary.

- 401(k): Employer matching is common in private companies and is often used as a competitive employee benefit.

- 403(b): Employer matching varies. Some nonprofits and schools have limited budgets, so matches may be smaller or absent.

When comparing plans, the employer match can be one of the most influential factors in long-term savings growth. Always contribute at least enough to receive the full employer match—it’s effectively a 100% return on that portion of your investment.

Schedules for Vesting

The process by which the funds your employer deposits into your account formally become yours is known as vesting.

- In 401(k)s, vesting schedules are common, ranging from immediate to six years.

- In 403(b)s, vesting periods tend to be shorter, and some nonprofit employers offer immediate vesting, especially if they don’t match contributions frequently.

Knowing your vesting schedule is vital. If you leave a job before you’re fully vested, you may forfeit some employer-contributed funds.

Roth Options and Tax Treatment

There are two main categories for both plans:

- Traditional (Pre-Tax): Contributions reduce your taxable income now, but withdrawals in retirement are taxed.

- Roth (After-Tax): Contributions are made after taxes, but withdrawals in retirement are tax-free.

Roth 401(k) vs Roth 403(b)

Both Roth versions offer similar tax advantages. The key is whether your employer provides the Roth option. Most private companies now offer Roth 401(k)s, while some 403(b) sponsors are still catching up.

The decision between traditional and Roth contributions depends on your current vs. future tax rate expectations. If you expect to be in a higher tax bracket later, Roth contributions may make more sense.

7. Choosing Between a 401(k) and 403(b)

If you’re deciding between two job offers—one offering a 401(k) and another offering a 403(b)—your choice should consider:

| Factor | 401(k) | 403(b) |

| Employer Type | Private company | Nonprofit or public institution |

| Investment Options | Broader selection | More limited (mutual funds, annuities) |

| Fees | Usually higher | Often lower |

| Employer Match | Common | Varies |

| Catch-Up Options | Standard IRS | Extra 15-year rule |

| Oversight | ERISA-governed | May be non-ERISA |

| Vesting | May take years | Often immediate |

Ultimately, the best plan depends on your employer type, available match, and investment preferences.

If both plans are available, compare fees, fund choices, and matching contributions before committing.

In conclusion: 401(k) vs 403(b): Understanding the Key Differences

While 401(k) and 403(b) plans share many similarities, understanding their key differences can empower you to make smarter retirement decisions.

- 401(k)s are ideal for private-sector employees seeking broader investment options and competitive employer matches.

- 403(b)s serve nonprofit and educational workers, often with lower fees and unique catch-up benefits.

No matter which plan you have access to, the key is to start early, contribute consistently, and review your strategy annually.

Retirement security isn’t just about having a plan—it’s about knowing how to use it wisely.

How U.S. Farmers Use Agricultural Loans to Grow, Manage Risk & Innovate

How U.S. Farmers Use Agricultural Loans to Grow, Manage Risk & Innovate